Written by: Meredith F. Piotti, David Greenfield

Over the past two years, the country (and the world) has dealt with an immense amount of uncertainty. Local, state, and even global economies have all been impacted in various ways. Financial institutions need to be uniquely prepared for a constantly changing credit risk environment as regulatory protections have expired, economic factors remain in flux, and individuals and businesses try to move forward.

Increasing Credit Risk

Credit risk assessment is an elevated area of concern as we move out of the pandemic. Businesses and consumers have been impacted in a variety of different ways and each loan segment will need to be considered differently. Critical areas to consider include:

- Reduced business activities in certain industries have contributed to volatile fluctuation of unemployment and uncertainty in future employment.

- Commercial real estate is changing as companies adopt more flexible work arrangements and develop a remote workforce.

- Government relief programs and stimulus income were able to aid borrowers and businesses alike, but now that those programs have ended there will be an increase in problem loans and charge-offs.

- The current residential housing market and asset valuation has helped mitigate the severity of this elevated credit risk.

- Lower-wage earners appear to have been impacted the most and will likely continue as foreclosure moratoriums and increased assistance programs come to an end. The ripple effect of this impact could affect multifamily homes and other collateral.

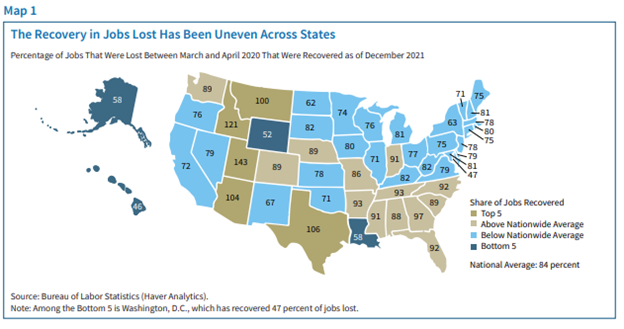

FDIC’s 2022 Risk Review provides an overview with supporting data depicting key issues that are impacting different segments of a bank’s portfolio that may assist financial institutions in considering the above areas. Here’s one example of how the economic factors vary across the country:

Once you understand your levels of credit risk it is critical that you have practices in place to mitigate and monitor that risk.

Effectively Managing Credit Risk

In August 2020, there was a joint statement issued by the Federal Financial Institutions Examination Council (FFIEC) members. FRB, FDIC, NCUA, OCC, and CFPB spoke to the current credit risk environment. They noted the following risk management and consumer protection principles that financial institutions should consider while working with borrowers toward the end of the initial pandemic and relief period:

- Prudent risk management

- Well-structured and sustainable accommodations

- Consumer protection

- Sound accounting and regulatory reporting

- Strong internal control systems

The noted guidance calls on financial institution personnel to proactively monitor the performance of credit portfolios and prudently work with borrowers who may not be able to service their contractual debts.

Financial institutions should ensure they have adopted the following proactive and prudent risk management tactics:

Increase efforts to proactively measure and monitor risky borrowers, especially those who have received deferments and/or other relief accommodations. This ensures that risk ratings and accrual status decisions are accurately applied.

Critically evaluate their loan loss calculation related assumptions and monitor them on a more frequent basis to verify accuracy for the current period.

Use a model analysis-based approach, such as sensitivity analysis, to stress the data and see the potential impact under realistic stress scenarios to prepare for the worst-case scenarios.

Proactively implementing a credit risk management system will ensure that a financial institution is prepared for the outcome of future decisions and/or external factors.

Borrower Accommodations

During the pandemic, we saw people band together to help each other out in a variety of different ways, including economic relief. Furthermore, financial institutions worked with borrowers to be accommodating and cooperative, while maintaining sound business practices and complying with ever-changing regulatory compliance laws. The graph below shows that for most of the pandemic, only a small amount of the portfolios had payment issues.

However, as economic uncertainty continues, and benefit programs end, it is important for institutions to review the loans that were impacted by these accommodations. Hopefully, these accommodations helped borrowers during a difficult time, but they could be the place where cracks first form in financial institutions’ portfolios.

Conclusion

Ultimately, the ability and effectiveness of addressing credit risk is up to each individual financial institution and its management. It will need to start from the top of the organization and make its way down with a sound tone at the top, strong risk management practices noted above, and consistent application of those practices. Establishing a sound and consistent approach can mitigate current and future credit risk issues and tackle any future losses of the financial institution and its borrowers.

Learn More