In 2022, we saw a significant market capitulation that demonstrated the downside of an unregulated market space with high levels of public interest. Terra/LUNA, FTX, and Three Arrows Capital, among others, became headlines that drew ire from the public media. However, ARK Invest still defines blockchain technology as the most noteworthy innovation in recent history, with cryptocurrencies having the potential to command $20 trillion in market capitalization in the next decade, a 20x growth potential from 2022’s value.

The Transformative Potential of Public Blockchain

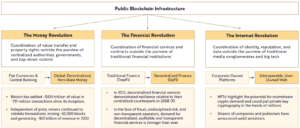

Public blockchains are the pillar of this opportunity, which can lead to revolutions in money, finance, and the internet as this converges to the forefront of coordination in infrastructure. Notably, public blockchain infrastructure can support billions of people living in areas of the world that do not have strong traditional banking mechanisms or live under authoritarian regimes that control financial markets outside of an individual’s control. Costly remittances, peer-to-peer payment access solutions, and rapid inflation are significant financial risks that can likely be solved with a sustainable use case in public blockchain infrastructure, such as Bitcoin.

The Internet Revolution and the prevailing world demographic becoming digitally native will rely heavily on the concept of public blockchains. Traditional internet is monopolistic, allowing large companies to monetize user data and create privacy concerns, as seen in recent history with Meta’s use of Cambridge Analytica. Web3 has been developed utilizing the public blockchain infrastructure and the concept of interoperable and global peer-to-peer transparent networks that allow users to distribute their data safely and privately. Significant global brands, such as Starbucks, Coca-Cola, Nike, and others have begun leveraging Web3 infrastructure in their strategic plans.

Overall, consumers are looking for new ways to engage with Web3 infrastructure, and it is in many companies’ best interests to adopt a fast-follower mentality. Companies should consider and assess where public blockchain infrastructure can be leveraged as part of their strategic plan. As world economies and consumers become digitally native, it is critical for companies in all market verticals to evaluate this new technology as part of their core competency.

This is one piece in a series covering ARK Invest’s “Big Ideas” for 2023 — head to our table of contents to read more!