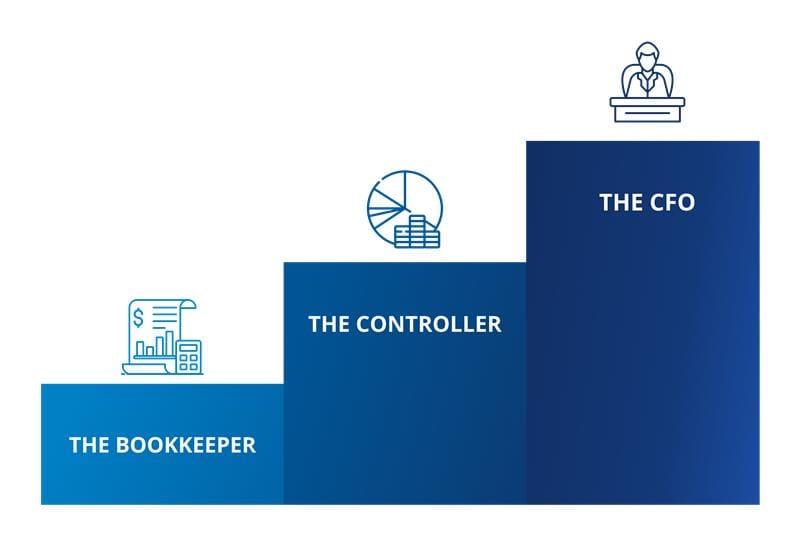

CFO, Controller, or Bookkeeper: What You Need & When You Need It

Key Takeaways:

- As your business grows, you may not have the bandwidth to handle all of the day-to-day financial details – that’s where a bookkeeper can step in.

- A controller is specifically focused on the financial aspects of your business.

- Beyond straight accounting and finance, your CFO can drive major strategic initiatives of your company.

Your business started as a single idea. An idea with so much promise that you just knew the world would see it. The people you have working for you are experts in chemistry, robotics, AI, or gene sequencing. They focus on what they do best so that the company can achieve its vision. Sometimes the developments happen one on top of the other, and sometimes they arrive after such a slow boil that when success finally does come, you have to grab on with both hands. When this happens, you need to make sure you have the right financial personnel in place. Poor financial management is one of the common denominators of companies closing their doors before they can change the world. Accounting, fund raising, budgeting, and cash flow management are complicated subjects with many potential hazards. Keep reading to learn if you need a bookkeeper, controller, or chief financial officer (CFO) as your guide, and the differences between the assistance each can provide.

More Than Just a Checkbook: The Bookkeeper

In the beginning, it’s a home office with one employee – you. As you gain momentum, you may incorporate the business and add a few other co-founders or employees. Your payroll swells from one to three! This is a huge step. You now have other people depending on the company for their livelihood and as an entrepreneur – this means that you are probably not able to handle all of the day-to-day financial details. You grow a little bit more. You rent office space and purchase equipment. This is about the time where you need someone with basic accounting knowledge to help you make sure your debits and credits are going in the right columns. A bookkeeper is the perfect choice for you at this stage in your development. This individual will be able to record your payables and receivables, ensure payroll is being met every pay period, and do some basic reporting about where the money went. They will be taking care of the task that most people find very mundane in their personal lives: balancing the checkbook.

Factors that will indicate readiness to go to the next level of financial expertise are:

- Oversight of basic accounting is becoming too time‐consuming or overwhelming when combined with other office duties.

- You need help developing an operating budget, forecast, or financial model for the company.

- You have potential investors besides friends and family.

- Your revenue is ramping up over continuous periods.

Blocking & Tackling: The Controller

Your business is growing at a good pace. You’ve secured your first venture or angel financing and you need someone to support those relationships. A controller is specifically focused on the financial aspects of your business. They will have significant knowledge of General Accepted Accounting Principles (GAAP) and be able to help you manage your cash flow, develop operating budgets, and build a financial model for your business. This is also the period of time where your internal controls over financial reporting become more important. You implement segregation of duties so that no single employee has complete control of the company’s financial situation. The controller should also have knowledge specific to your industry. They should understand the issues of revenue recognition or enough about share‐based compensation to help you set up a program to assist in your employee recruiting efforts.

As time goes by, your company may be receiving more interest from the press, you may have received calls from venture capitalists or other investors, and perhaps there has been talk of an initial public offering (IPO). You may have just brought on a new development team and you now have over 30 people on your payroll. These types of activities signal that the financial landscape of your company will become increasingly complicated and may require the help of a CFO. Other signals that you’re ready for the financial professional that helps develop strategy are:

- You are pursuing significant later-stage venture capital.

- You are considering international operations.

- Investors are requiring more frequent and more sophisticated financial information.

- You have complex banking relationships.

- There is rapid expansion in your business.

Strategist & Confidant: The CFO

In the past, your financial people have been doing as you’ve requested and reporting the results back to you. A CFO is a part of your management team, filling that role in your stead. This person helps as a strategic partner and advisor across functional areas. The CEO/CFO relationship is critical as the CFO is frequently the CEO’s “right hand” and trusted advisor. Expect deep rooted GAAP and finance knowledge, cash management skills, and treasury experience. Beyond straight accounting and finance, your CFO may wear many additional hats, especially early on, including deeper financial planning and forecasting, strengthening internal controls, putting a proper corporate governance structure in place, working directly with the HR, and working directly with the investor relations team. Any major strategic initiative of the company should be driven by the CFO, including:

- Acquisitions or divestitures,

- Geographic expansion,

- Product line expansion,

- Sales channel changes,

- Or product pricing.

But more importantly, your CFO is a key advisor to the CEO as well as the board of directors by providing and interpreting key financial data in order to allow others to understand the business and impact of critical decisions.

Whether your company is ready for a bookkeeper, controller, or CFO, Wolf & Company can help. Our Outsourced Accounting Solutions (OAS) team offers expertise in each of these roles. We work closely with your leadership to ensure that you are receiving service tailored directly to your goals and needs. Contact our OAS team today, and see how we can help your company prosper.