The customer has spoken: Financial institutions, if you don’t provide us with the services and access we want, we will flirt with other players in the market. Many financial institutions have gotten the memo and are quickly modernizing processes and partnering with providers to enable a more interactive and accessible banking experience. But all this change does not come risk free. Unlike unregulated entities, financial institutions have several points they must ensure they address as they battle for relevancy. Here are the top three critical regulatory processes you must secure to avoid digital disaster:

1. Bank Secrecy Act (BSA)/Anti Money Laundering (AML)

This always-present regulatory hot button presents new consideration points when undergoing digital transformation. Making yourself more accessible may also mean opening your virtual doors to new and different types of customers. As you implement new channels and new technologies, you will need to make sure they are properly integrated into your AML monitoring program and that your monitoring parameters consider the risks present in your expanded client population.If your BSA policy restricts specific types of customers, you will want to make sure there are preventative and detective controls in place to identify and restrict these clients from utilizing your services. If you are changing or expanding your customer risk tolerances as part of this transformation, it is important that this is incorporated into your BSA/AML risk assessment to identify the requirements and level of risk associated with the types of transactions and activities your company is performing. This updated risk assessment should serve as the foundational element to update your monitoring program including the associated policy, procedures, and training program. 2022 started off with a lot of headlines about AML related enforcement actions and we’ve continued to see increased scrutiny over this area, especially citing banks whose monitoring programs fail to incorporate new business partners, new channels, and customer products.

2. Fair Lending

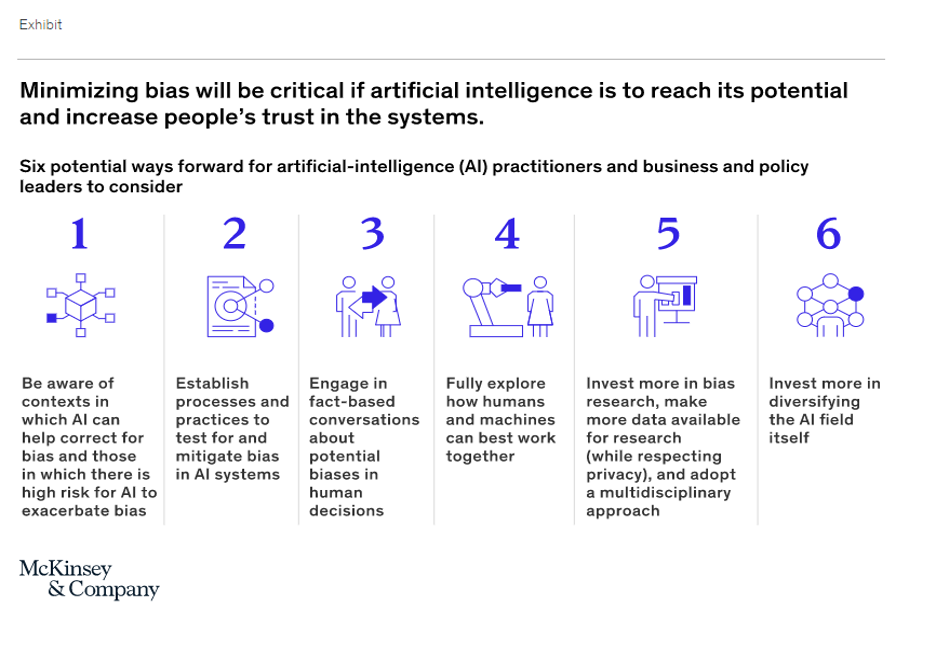

With the pressure to speed up the approval process on loans comes a reliance on systems and machine learning to augment or perform the analysis of a borrower’s creditworthiness. Left unchecked, these systems can make decisions that may constitute a fair lending violation. To ensure this does not occur, it is important that when the system is implemented the rules are clearly analyzed to not present a violation and that ongoing monitoring is performed to ensure that technology left unchecked has not created a bias.

Source: McKinsey & Company

3. Monitoring Consumer Complaints

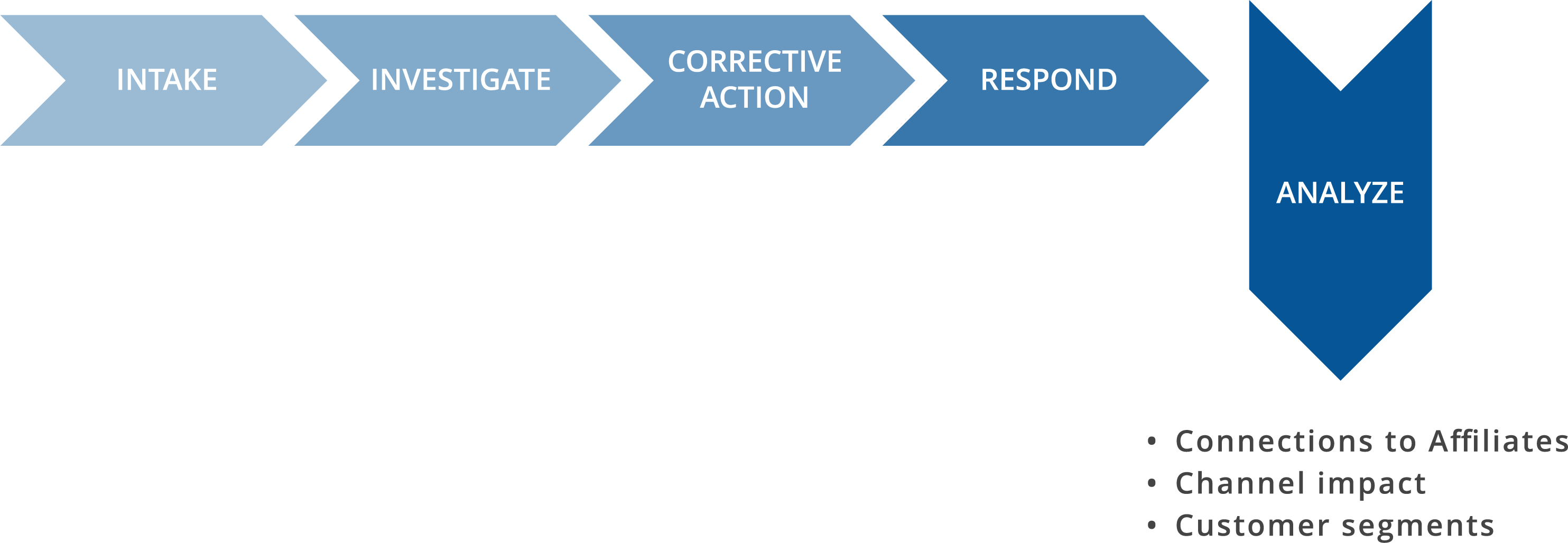

Establishing an effective program to track, resolve, and respond to customer complaints has multiple benefits beyond just meeting your regulatory obligation. Tracking this information helps to monitor customer satisfaction and facilitates trend analysis that can assist management in identifying weaknesses and points of improvement within your product offering, personnel, or third-party relationships.

Financial institutions have the benefit of their strong compliance programs and specialized knowledge when it comes to preventing regulatory headaches – these should be seen as assets in the digital transformation process. To capitalize on them, regulatory considerations must be analyzed early and with a degree of creativity to allow financial intuitions to meet future demands. Compliance professionals should be seen as your champions to ensure continued success versus creating barriers. This can be accomplished by notifying them earlier and working with them collaboratively.

Whether you’ve just started considering digital transformation, or you’re already in-process, Wolf & Company can help – reach out today and take advantage of our expertise, as well as our digital transformation roadmap.